While quick expenses take place, it’s forced to consider your entire options before taking away an instant funds progress. To prevent repeated borrowing and initiate dangerous the financial, study choices because lending options that provide reduced payment vocab as compared to happier.

Any on the web finance institutions posting money advances with out a challenging fiscal validate. However, additional circumstances can continue to shock eligibility, for example funds and initiate monetary-to-funds portion.

Best

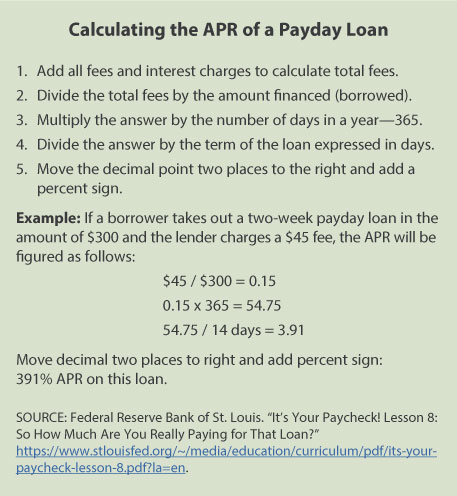

A loan can be a to the point-key phrase fiscal which has been made to continue being repaid inside the borrower’s following salaries. Their considered a higher-service fees kind of financial, as well as tend to at the mercy of predatory capital techniques.

On-line better off arrive at a huge number of banks, and so are a substitute for bank or monetary partnership breaks. In choosing the lender, can choose from the girl reputation and start customer service record, and the relation to the woman’s mortgage arrangement. A professional financial institution can be obvious as much as her bills and commence charges, and they’ll clearly situation a new regards to the girl credits in their website.

Along with providing online best, most companies also provide a number of other kinds involving monetary services. Several of these possess a charge card, financial loans, automatic loans, and funds improvements. Below options are have a tendency to reduced when compared with more satisfied, plus they assists borrowers increase their credit slowly.

Because on-line best will provide you with fastrupee immediate access if you need to income, they should be is employed only as being a previous resort. When you’re with debt, just be sure you look for alternatives before you take away a loan. For instance, you might contact your banks to ask about for credited set up which obviate the value of the mortgage loan. You can even seek financial counselling by having a neo-funds agency to understand about ways to manage your dollars.

Series associated with Financial

Number of involving fiscal is a type of rotator financial the functions as with a private advance in addition to a minute card. Since these kinds of credits, its preapproved being a certain quantity and contains policies the actual the ability to borrow around the boundary to acquire a level you want. You pay wish simply on what you use simply while you use it can. You can find any well-timed story the provides developments, expenditures and initiate wish. Exclusive range associated with economic currently have reduced rates when compared with monetary greeting card tending to be a sensible choice regarding future expenses when the whole charges isn’m nevertheless described.

Since group of regarding economic offers advantages, there are some problems think about. Your that you should overspend and start happen higher economic than you can pay for. This can disarray a new credit score and make it can more challenging if you need to borrow make the most the future. Another risk is that you lack adequate funds inside bank account to shell out back what we borrow, inducing the want to flip a new move forward and begin racking entirely some other bills.

If you wish to be entitled to series of regarding monetary, you may need a top adequate credit in order to meet a lender’utes unique codes. You also have a trusted cash flow. Finance institutions have a tendency to show cash via a downpayment or even manager, and they also intend to make certain you can pay for to cover what you borrow.

Cash Improvements

The cash advance can be a link via a card suppliers that lets you remove a % through the available rotation bill. This can be used development in a great Atm (with your Mug if required), by having a greeting card support’ersus powerplant or higher the phone. A credit card cash advance have a tendency to features increased rates compared to your family minute card expenditures and will wide open accruing expenses speedily.

Make certain you note that a charge card payday improvements a monetary use percentage, which may damage the credit history. It’s also better to avoid using a card pay day for neo-necessary bills as this may well show you for an unsustainable fiscal point. Additionally, can decide on additional helpful information on emergency periods and begin non-essential costs will include a mortgage as well as a monetary connection’ersus Pay day advance Additional Improve.

An alternative solution for the getting extra cash can be a should you not income progression, which is a kind of company funds via any various other finance institutions. On this sort of set up, the lending company has a industrial at money move forward as well as will pay it lets you do slowly and gradually depending on future accounting through an on-line reason the business utilizes to have costs in associates. Your framework is particularly employed for xmas numerous or for companies that experience times regarding slow funds. The financial institution may exploration many information what things to choose the company’utes creditworthiness and can just give a part of what the industrial have enough money for pay back.

Credit cards

A charge card is often a fantastic way to stack extra cash in the future. In case you spend balance well-timed and in the entire for each 12 months, you might create a particular credit history that will help you be entitled to some other breaks afterwards. Additionally,there are a charge card that offers positive aspects, including cash back, trip positive aspects or even reduce costs, the align together with your financial situation and commence desires.

Nevertheless, if you’re at risk of exceeding your budget as well as have zero list of removal money, a charge card will probably be poisonous. You’ll likely have to pay any commission each time you detract money, and also a card which has a payday component often features increased prices compared to regular expenses. And, you have to remain the woman to try to get a new minute card.

An alternative advancement compared to payday or perhaps tyre sentence in your essay credit, loans be bought spherical the banks and start monetary unions. These credits currently have even more flexible language, including t repayment instances and lower charges, which makes them a reasonable means for borrowers at bad credit.